Income investing is a disciplined approach focused on generating a steady cash flow from investments, typically through dividend-paying stocks, bonds, and other income-generating assets. Unlike growth investing, which prioritizes capital appreciation, income investing strategies emphasize consistent income streams.

In this detailed guide, let us explore what is income investing, its pros and cons, and what comprises a reliable income investing portfolio.

We will also explore the role of inflation and interest rates in income investing, and overview the strategies of top-income investors.

Understanding Income Investing Strategy

The primary goal of income investing is to produce steady earnings to support living expenses, save for retirement, or achieve financial stability. This approach involves selecting a diverse mix of income-generating assets to ensure a steady flow of cash.

Diversification is a critical component of this strategy, as it involves spreading investments across various asset classes, such as bonds, dividend-paying stocks, and real estate. This diversification helps minimize risk and maximize income potential by reducing the impact of any single investment’s poor performance on the overall portfolio.

Additionally, effective risk management is essential in maintaining a stable income stream. This involves managing different types of risks, including interest rate risk, credit risk, and market risk, to ensure that the income remains predictable and stable, even in fluctuating market conditions.

Key Components of a Basic Income Investing Portfolio

A basic income investing portfolio is designed to generate a steady and reliable stream of income. The key components of such a portfolio include various income-generating investments that balance risk and return, ensuring a stable cash flow. Here are the primary elements:

Government Bonds:

Government bonds are essential for a basic income investing portfolio due to their low-risk nature. These bonds involve lending money to the government for a specified period, in exchange for regular interest payments and the return of principal at maturity. Government bonds are considered very safe, offering lower yields but providing a reliable source of income, making them attractive for conservative investors.

Dividend-Paying Stocks:

Stocks that pay dividends are crucial for generating income within a portfolio. Dividend-paying stocks represent shares in companies that distribute a portion of their earnings to shareholders regularly. Blue-chip stocks, such as those from Johnson & Johnson and Coca-Cola, are popular for their stable and growing dividends. High-dividend stocks, often found in sectors like utilities and telecommunications, provide higher yields. Preferred stocks, which offer fixed dividend payments and a higher claim on assets than common stocks, are also a reliable income source, contributing to the portfolio’s stability and income potential.

Corporate Bonds:

Corporate bonds are similar to government bonds but involve lending money to companies instead of the government. These bonds typically offer higher yields than government bonds due to the increased risk. Investors receive regular interest payments and the principal amount at the end of the bond’s term. Corporate bonds are essential for an income investing portfolio, providing a balance between risk and reward while generating consistent income.

Real Estate Investment Trusts (REITs):

REITs are another vital component of an income investing portfolio. They own and operate income-producing real estate and distribute a significant portion of their income as dividends. This makes REITs attractive for income investors seeking diversification beyond traditional stocks and bonds. They provide a steady stream of rental income and offer potential long-term capital appreciation, enhancing the portfolio’s overall income generation.

Interest Payments Accounts:

Interest-bearing accounts, such as savings accounts and certificates of deposit (CDs), provide a safe and low-risk means of generating income. These accounts offer regular interest payments and are typically insured by government agencies, ensuring the security of the invested capital. Money market mutual funds also fall into this category, offering liquidity and periodic income through dividends and interest payments. These accounts are essential for conservative investors seeking stable and predictable income.

Advantages of Income Investing

Here are some key advantages of income investing:

- Regular Cash Flow: Income investing provides a steady stream of cash flow through dividends, interest, or rental income, which can be especially beneficial for retirees or those seeking supplemental income.

- Lower Volatility: Income-generating assets, such as bonds and dividend-paying stocks, tend to be less volatile than growth stocks, offering a more stable investment option.

- Capital Preservation: Income investing often involves investing in established companies with strong financial health, which can help preserve capital and reduce the risk of significant losses.

- Compounding Effect: Reinvesting the income generated from investments can lead to compound growth over time, significantly enhancing overall returns.

- Inflation Protection: Some income-generating assets, like inflation-protected bonds (TIPS) or real estate, can provide a hedge against inflation, ensuring that the purchasing power of income remains intact.

- Passive Income: Income investing can provide a source of passive income, requiring less active management compared to other investment strategies like trading or growth investing.

- Predictable Returns: Regular income payments from bonds or dividend-paying stocks can offer more predictable returns compared to the uncertain capital gains from growth stocks.

- Risk Management: Incorporating income investments into a portfolio can help balance risk, particularly in volatile market conditions, providing a more balanced and resilient investment approach.

Risks and Considerations In Income Investing

When constructing an income investing portfolio, it is crucial to understand the various risks and considerations that can impact the stability and effectiveness of your investments. Key points to consider include:

- Interest Rate Risk: Rising interest rates can reduce the value of existing bonds and affect the prices of income-generating stocks.

- Credit Risk: There is the risk that the issuer of a bond or other income-producing asset may default on payments.

- Market Risk: Stock prices can fluctuate due to broader market conditions, impacting the value of dividend-paying stocks and REITs.

- Company-specific Risk: For dividend-paying stocks, company-specific factors such as poor management, financial distress, or industry downturns can affect dividend payouts.

The Role of Interest Rates and Inflation in Income Investing

Income investing is a strategy focused on generating a steady stream of income through dividends, interest payments, and other periodic returns. The dynamics of interest rates and inflation also play pivotal roles in shaping the landscape of income investing.

Understanding how inflation and interest rates interact, and the subsequent impact on income-generating investments, is crucial for investors aiming to optimize their portfolios.

The Impact of Inflation on Income Investing

Inflation can erode the real value of fixed-income investments, such as bonds. For instance, if an investor holds a bond with a fixed interest rate of 3% per annum and inflation rises to 4%, the real return on that bond becomes negative, effectively reducing the investor’s purchasing power. This scenario highlights the importance of considering inflation when evaluating the potential returns from income investments.

Dividend-paying stocks are another popular choice for income investors. While dividends can provide a hedge against inflation, as companies often increase payouts to keep pace with rising prices, not all companies have the capacity to do so. Investors must be discerning, selecting companies with strong cash flows and a track record of consistent dividend growth.

The Role of Interest Rates in Income Investing

Interest rates directly affect the returns on income-generating investments. As interest rates increase, new bonds provide higher yields, reducing the appeal of existing bonds with lower yields. This dynamic can lead to a decrease in the market value of existing bonds, impacting investors who may need to sell their holdings before maturity.

Conversely, when interest rates fall down, the value of existing bonds with higher yields increases and benefits the bondholders. This is why rate cuts by central banks can be advantageous for bond investors. However, prolonged periods of low interest rates can pose challenges for income investors seeking adequate returns, prompting a shift towards higher-risk investments, such as high-yield bonds or dividend stocks.

Case Studies of Successful Income Investors and Their Investment Portfolio

By exploring the case studies of some of the most successful income investors and the strategies they employ to achieve their financial goals, we will learn how income investors, including experienced portfolio managers, effectively generate income and build resilient portfolios.

Case Study 1: John D. Rockefeller – The Industrial Magnate

John D. Rockefeller, one of the wealthiest individuals in history, was not only a titan of industry but also a savvy income investor. His strategies for generating income were rooted in his business acumen and keen understanding of market dynamics.

Strategy: Investing in Dividend-Paying Stocks and Reinvestment

Rockefeller’s income investing strategies centered on owning dividend-paying stocks, particularly in the oil industry, where he had substantial expertise. He believed in the power of reinvestment, using the dividends earned to purchase additional shares and compound his wealth over time.

Key Takeaways:

- Industry Expertise: Rockefeller leveraged his deep understanding of the oil industry to make informed investment decisions.

- Reinvestment: By reinvesting dividends, he compounded his returns and enhanced his income generation capacity.

- Patience and Discipline: Rockefeller maintained a disciplined approach, holding onto investments for the long term to reap the benefits of compounding.

Case Study 2: Warren Buffett – The Oracle of Omaha

Warren Buffett, known as the Oracle of Omaha, is celebrated for his value investing prowess. However, his investment strategy also includes a significant focus on income investing. Buffett’s ability to generate income through his investments is a cornerstone of his overall strategy.

Strategy: Selecting Reliable Dividend-Paying Stocks

Buffett’s approach to income investing involves selecting companies with strong financial health and a history of paying reliable dividends. He emphasizes companies with sustainable business models, strong competitive advantages, and the ability to generate consistent cash flow.

Key Takeaways:

- Moats and Dividends: Buffett looks for companies with competitive advantages (“moats”) that can sustain and grow their dividend payments.

- Financial Strength: He prioritizes companies with strong balance sheets and healthy cash flow to ensure dividend sustainability.

- Long-Term Focus: Buffett holds onto his dividend-paying stocks for the long term, benefiting from both income and capital appreciation.

Case Study 3: Geraldine Weiss – The Dividend Detective

Geraldine Weiss, known as the “Dividend Detective,” is a pioneering female income investor. Her focus on dividend-paying stocks and disciplined investment strategy has made her a role model for many income investors.

Strategy: Dividend Yield and Dividend Growth

Weiss’s income investing strategy revolves around selecting stocks with attractive dividend yields and a history of dividend growth. She developed a methodology that involved buying stocks when their dividend yields were near historical highs and selling when yields were low.

Key Takeaways:

- Dividend Yield Strategy: Weiss focused on stocks with high dividend yields, buying at historical highs to maximize income.

- Dividend Growth: She prioritized companies with a history of increasing dividends, ensuring a growing income stream.

- Market Timing: Weiss’s approach included elements of market timing, buying, and selling based on dividend yield fluctuations.

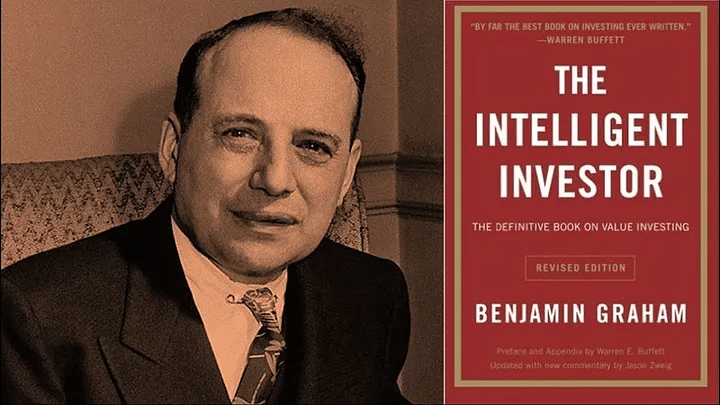

Case Study 4: Benjamin Graham – The Father of Income Investing

Benjamin Graham also made significant contributions to income investing. His approach was deeply rooted in preserving capital and generating steady income, particularly through bonds and dividend-paying stocks.

Strategy: Focus on High-Quality Bonds and Dividend Stocks

Graham’s income investing strategy was anchored in the principles of safety and quality. He advocated for investing in high-quality bonds, such as government and municipal bonds, which offer stable and predictable income. Furthermore, Graham emphasized the importance of dividend-paying stocks, particularly those with a long history of stable and increasing dividends. This focus on dividend income ensured that his investments would generate income consistently over time.

Key Takeaways:

- Quality Over Yield: Graham prioritized high-quality, lower-yielding bonds and stocks over higher-yielding, riskier options.

- Diversification: He diversified his portfolio across various sectors and asset classes to mitigate risk.

- Long-Term Horizon: Graham’s strategies were designed for long-term income generation, with a focus on stability and preservation of capital.

Case Study 5: John Neff – The Contrarian Income Investor

John Neff, renowned for his tenure as the portfolio manager of the Windsor Fund, is celebrated for his contrarian investment style. Neff sought out undervalued stocks with high dividend yields, often investing in sectors and companies that were temporarily out of favor. His unique approach to income investing combined a keen sense of market timing with a focus on fundamental value.

Strategy: High-Yield Stocks and Contrarian Investing

Neff’s strategy revolved around identifying high-yield stocks that were undervalued by the market. His contrarian approach meant that he was willing to go against the grain, investing in companies and sectors that others shunned. He believed that these stocks offered both substantial income through dividends and potential for price appreciation as the market eventually recognized their true value.

Key Takeaways:

Contrarian Approach: Neff’s willingness to invest in out-of-favor stocks was a defining characteristic of his strategy. By going against prevailing market sentiments, he could purchase high-quality stocks at lower prices, thereby securing higher dividend yields.

Value and Income: Neff combined value investing principles with income generation. He focused on finding stocks that were undervalued based on their fundamentals, ensuring that they offered attractive dividend yields.

Patience and Discipline: Neff’s strategy required patience and confidence in his investment thesis, often holding onto stocks until the market recognized their value.

Common Strategies Adopted by Successful Income Investors

The case studies above highlight several key strategies that successful income investors adopt:

Focus on Quality

Investing in a high-quality, financially stable company with a strong track record of dividend payments is a common theme. This approach ensures a reliable income stream and reduces the risk of dividend cuts.

Dividend Investing

Dividend investing is a cornerstone strategy for income investors. Investing in dividend-paying stocks allows investors to create a consistent income stream.

Asset Allocation

Asset allocation involves balancing the portfolio across different asset types to optimize returns and manage risk. By allocating investments among equities, bonds, real estate, and other assets, investors can achieve a well-rounded portfolio that generates income and offers growth potential.

Reinvestment

Reinvesting dividends and interest income is a powerful strategy for compounding returns. By using the income generated from investments to purchase additional shares or units, investors can enhance their overall returns and build wealth over time.

Conclusion

Income investing is a strategy tailored for individuals seeking stable and predictable returns, making it particularly appealing to retirees or those looking to supplement their income. Whether you are new to income investing or an experienced veteran, these case studies highlight the importance of a disciplined and strategic approach to building a reliable and growing income stream. By learning from these successful investors and implementing powerful income investing strategies, you can work towards achieving your financial objectives and enjoying the benefits of a steady and sustainable income.