Investing is a journey filled with opportunities and risks, and the decisions we make along this path can be significantly influenced by our mindset. Behavioral finance, a field that blends psychology and economics, sheds light on why investors often make irrational decisions. Cognitive bias and emotions can significantly influence investment choices, leading to suboptimal outcomes.

Cognitive biases affect human judgment in the context of investment decisions, often leading to errors in evaluating risks and returns.

To navigate these challenges, investors should adopt strategies rooted in behavioral finance principles. Recognizing and addressing biases, setting clear and rational investment goals, practicing disciplined decision-making, and maintaining a long-term perspective is essential. Implementing these strategies can help investors make more rational choices, avoid common pitfalls, and achieve better financial outcomes.

In this detailed guide, we will discuss what is cognitive bias, and how does it affect people in the investing world. We will also explore how psychological factors, including emotions, fear, and cognitive biases, shape stock market trends and influence trader behavior along with some ways to overcome these behavioral pitfalls.

What is Cognitive Bias?

A cognitive bias is a consistent pattern of deviation from rationality in judgment, where people process and interpret information in a way that influences their decisions and perceptions. These biases arise because the human brain, while powerful, simplifies information processing through mental shortcuts or “rules of thumb.” This can help us make quick decisions but often leads to errors in judgment.

In the context of investing, cognitive biases can cause us to misinterpret data, make different conclusions, overlook important details, or make emotional rather than logical decisions. Recognizing and understanding these biases is crucial for making more informed and rational choices. The cognitive reflection test is used to measure individual differences in susceptibility to cognitive biases.

Common Cognitive Biases in Investing You Should Look Out For

1. Overconfidence Bias

Overconfidence bias occurs when individuals overestimate their knowledge, abilities, or predictive accuracy. In the context of investing, this bias manifests as investors believing they possess superior skills or insights that enable them to outperform the market. They might think they can pick winning stocks more effectively than others, leading to excessive trading.

This increased activity not only incurs higher transaction costs but also exposes them to greater market volatility and risk. Overconfidence can cause investors to underestimate the possibility of losses, leading them to take on riskier investments without adequate consideration of potential downsides. This false sense of security can result in significant financial setbacks when their predictions do not materialize.

2. Herding Bias

Herding bias describes the tendency for individuals to mimic the actions of a larger group, often disregarding their analysis or the rationality of those actions. In investing, this behavior can drive market bubbles, where asset prices are inflated due to widespread enthusiasm, and subsequent market crashes when the bubble bursts. The dot-com bubble of the late 1990s and the housing market crash of 2008 are prime examples of herding bias.

Investors, driven by the fear of missing out (FOMO), may follow the crowd, buying into assets because everyone else is doing so, without conducting their due diligence. This collective behavior amplifies market movements, often leading to severe corrections when the herd reverses direction.

3. Anchoring Bias

Anchoring bias is a cognitive tendency where individuals rely excessively on the initial information they receive (the “anchor”) when making decisions. For investors, this might mean fixating on a stock’s initial price or the price at which they first bought it. They may become anchored to this initial value, ignoring subsequent data that indicates a significant change in the stock’s value.

This bias can prevent investors from adjusting their perceptions based on new, relevant information, leading to missed opportunities or overlooked threats. For example, if an investor buys a stock at $50 and it drops to $30, they might irrationally cling to the $50 anchor, waiting for the stock to return to that price instead of reassessing the situation based on the current market environment and external factors.

4. Confirmation Bias

Confirmation bias is the tendency to seek out, interpret, and remember information that confirms one’s preexisting beliefs while ignoring evidence that contradicts those beliefs.

In investing, this bias can lead investors to pay more attention to news and analysis that supports their investment decisions and disregard data suggesting otherwise. For instance, an investor who believes in the potential of a particular technology might selectively gather positive reports about it, ignoring signs of market saturation or competition.

This selective attention to ambiguous information can result in attentional bias and in a skewed understanding of the market, reinforcing poor decisions and leading to suboptimal investment outcomes. The investor’s portfolio may become imbalanced, with too much exposure to certain sectors or stocks based on biased information.

5. Loss Aversion

Loss aversion is the psychological phenomenon where the pain of losing is felt more acutely than the pleasure of an equivalent gain.

In investing, this means that investors are more likely to avoid losses than to seek gains. This bias can lead to irrational behavior, such as holding onto losing investments for too long, hoping they will rebound to avoid realizing a loss. Conversely, it this unconscious bias might also cause investors to sell winning investments prematurely to lock in gains, fearing that the profits could vanish. Both behaviors can disrupt a well-thought-out, long-term investment strategy, as the focus shifts from rational analysis to emotional reactions to gains and losses.

6. Recency Bias

Recency bias refers to the tendency to place undue emphasis on recent events or information over historical data.

Investors influenced by recency bias might overreact to short-term market movements, such as recent stock price trends or news events, at the expense of a broader, more balanced perspective. For instance, if the market has been rising for several months, investors might assume this trend will continue indefinitely, ignoring potential warning signs from longer-term data. This can lead to impulsive decisions, such as buying into overvalued stocks during a bull market or selling off investments in a panic during a downturn, ultimately undermining consistent and strategic investment planning.

The Impact of Cognitive Biases on Investment Decisions

Cognitive biases can significantly impact how people interpret information and make investment decisions. Cognitive biases often lead to systematic errors in judgment and decision-making, resulting in inaccuracies and irrational behaviors such as:

- Overtrading: Excessive buying and selling driven by overconfidence or herding can result in lower returns. When investors believe they have superior market insights or follow the crowd without independent analysis, they may trade more frequently, incurring costs that erode their overall gains.

- Under-diversification: Anchoring on familiar investments, leads to a lack of diversification and increased risk. Investors may stick to stocks or sectors they know well, ignoring the benefits of spreading risk across a variety of assets. This can make their portfolios more vulnerable to market fluctuations affecting those specific investments.

- Poor market timing: Investors influenced by recent market trends or driven by the fear of losses may act impulsively, buying assets when prices are high during a bullish market and selling them at a loss during downturns. This behavior undermines long-term investment strategies and can lead to suboptimal financial outcomes.

Understanding these cognitive biases is crucial for making more rational and effective investment decisions.

The Foundations of Trading Psychology

Unlike technical or fundamental analysis, which focuses on data and financial metrics, trading psychology examines the human element behind trading decisions. It is important to understand that markets are driven by people, and people’s decisions are often swayed by their psychological states.

Emotions in Trading

Emotions are an integral part of human nature and inevitably affect trading decisions. Key emotions that impact trading include:

- Greed: The desire for wealth can lead to risky trading behavior and over-leveraging. Greed can drive traders to hold onto positions longer than they should and hope for higher returns, which can lead to significant losses if the market turns.

- Fear: Fear can cause traders to act irrationally, either by selling positions prematurely to avoid losses or by refraining from entering potentially profitable trades. Fear often spikes during market volatility, leading to panic selling and market crashes.

- Overconfidence: After a series of successful trades, traders might develop overconfidence, leading them to take excessive risks. This can result in significant losses when the market doesn’t perform as expected.

- Regret: Regret from missed opportunities or past losses can lead to revenge trading, where traders make irrational decisions to recoup losses, often exacerbating their financial situation.

Negative stimuli, such as adverse market news or unexpected losses, can also significantly impact traders’ emotions and decision-making, often leading to hasty or irrational actions.

The Impact of Trading Psychology on Market Trends

The collective psychology of traders can shape market trends in profound ways. Here’s how individual differences in trading psychology influences the stock market:

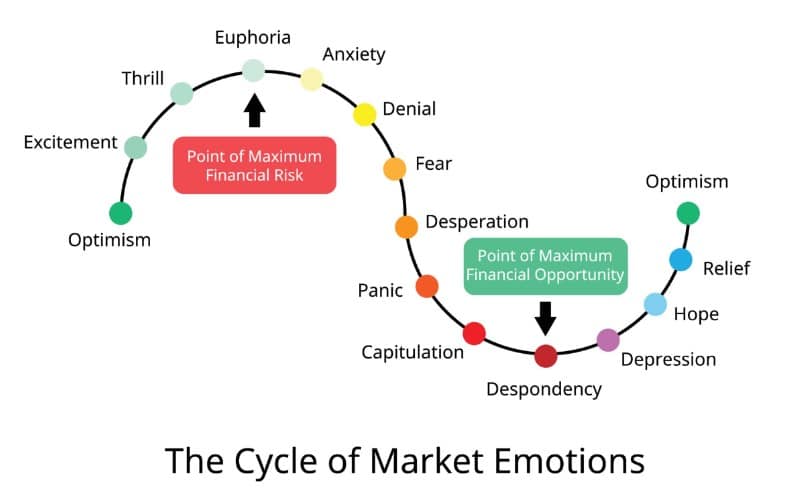

Market Sentiment

Market sentiment describes the general outlook and feelings of investors towards a specific security or financial market. It is influenced by emotions, news, and events. Positive sentiment can drive prices up, while negative sentiment can lead to market downturns. Market sentiment often becomes a self-fulfilling prophecy; if traders believe the market will rise, their actions will push prices up, and vice versa.

Volatility and Panic Selling

Emotions like fear and panic can lead to heightened market volatility. When traders collectively react to negative news or events with panic selling, it can cause sharp market declines. This was evident during the 2008 financial crisis and the COVID-19 pandemic, where fear-driven selling led to significant market downturns.

Bubbles and Crashes

Psychological factors such as greed and herd mentality can lead to market bubbles, where asset prices are driven to unsustainable levels. When the bubble bursts, fear and panic can cause a rapid sell-off, leading to market crashes. Historical examples include the dot-com bubble of the late 1990s and the housing bubble of the mid-2000s.

Feedback Loops

Feedback loops occur when traders’ actions amplify the effects of their beliefs and emotions through social behavior. For instance, if a large number of traders believe that a stock will rise; their collective buying can indeed push the stock price up, reinforcing their initial belief. This can create self-perpetuating cycles of buying or selling, leading to exaggerated market trends.

Strategies to Manage Trading Psychology

Understanding the role of trading in cognitive psychology can help traders develop strategies to manage their emotions and cognitive biases, leading to more rational decision-making. Here are some techniques to enhance trading in cognitive psychology:

Self-Awareness

Being aware of one’s emotions and biases is the first step towards managing them. Traders should regularly reflect on their trading decisions and identify patterns in their behavior. Keeping a trading journal can be an effective tool for tracking emotional responses and biases over time. Various techniques and therapies, such as debiasing through incentives, nudges, and training, as well as cognitive bias modification therapy, can help reduce cognitive bias in trading decisions.

Developing a Trading Plan

A well-defined trading plan can provide a structured approach to decision-making, reducing the influence of emotions. A trading plan should include entry and exit strategies, risk management rules, and criteria for evaluating trades. Sticking to the plan can help traders avoid impulsive decisions driven by fear or greed.

Risk Management

Effective risk management is crucial for maintaining emotional stability in trading. This includes setting stop-loss orders to limit potential losses and diversifying investments to spread risk. By controlling the downside, traders can reduce the emotional impact of losing trades and maintain a more balanced mindset.

Mindfulness and Stress Management

Practicing mindfulness and stress management techniques can help traders stay calm and focused. Techniques such as meditation, deep breathing exercises, and regular physical activity can reduce stress and improve emotional regulation, leading to more rational trading decisions.

Continuous Learning

The financial markets are constantly evolving, and continuous learning is essential for adapting to new trends and challenges. Traders should stay informed about market developments, study trading psychology, and learn from their experiences and those of others. This ongoing education can help traders refine their strategies and improve their psychological resilience.

5 Ways of Overcoming Common Behavioral Pitfalls in Investing

1. Recognize and Control Overtrading

Overtrading is a common behavioral pitfall where investors engage in excessive buying and selling of stocks, often driven by the illusion of control or the desire to capitalize on every market movement. This behavior can lead to higher transaction costs, increased tax liabilities, and suboptimal investment returns. Cognitive bias modification therapy (CBMT) can help investors manage these biases and improve their decision-making by reducing cognitive biases in judgment and decision-making.

How to Control Overtrading:

- Set Clear Trading Rules: Establish specific criteria for buying and selling stocks, such as target prices, valuation metrics, or technical indicators. Adhering to these rules can help you make more disciplined trading decisions.

- Use a Long-Term Perspective: Focus on the long-term potential of your investments rather than short-term market fluctuations. Avoid making impulsive trades based on daily market noise.

- Limit Trading Frequency: Set the maximum number of trades you can make in a given period (e.g., monthly or quarterly). This restriction can help you avoid the temptation to overtrade.

By implementing these strategies, you can reduce the tendency to overtrade and focus on building a well-thought-out, long-term investment portfolio.

2. Manage Loss Aversion

Loss aversion is a behavioral pitfall where investors fear losses more than they value gains. This bias can lead to irrational decision-making, such as holding onto losing investments for too long or selling winning investments too quickly to lock in gains.

How to Overcome Loss Aversion:

- Reframe Your Perspective: Instead of focusing on individual losses, consider your investment performance in the context of your entire portfolio. A holistic view can help you tolerate temporary setbacks.

- Set Predefined Exit Strategies: Establish clear criteria for selling investments, such as stop-loss orders or profit targets. Predefined exit strategies can help you make objective decisions and avoid emotional reactions.

- Focus on Long-Term Goals: Keep your long-term financial objectives in mind and avoid making decisions based on short-term market movements. Remember that temporary losses are a natural part of investing.

By managing your fear of losses and maintaining a long-term perspective, you can make more rational investment decisions and improve your overall investment performance.

3. Manage Emotional Reactions

Emotions play a significant role in investing, often leading to impulsive and irrational decisions. Fear and greed are two powerful emotions that can drive investors to buy high and sell low, contrary to the basic principle of buying low and selling high. Behavioral finance emphasizes the importance of managing emotions to achieve better investment outcomes.

How to Manage Emotional Reactions:

- Develop a Solid Investment Plan: A well-structured investment plan can serve as a roadmap during volatile market conditions. Define your investment strategy, asset allocation, and exit criteria in advance to minimize emotional decision-making.

- Implement Stop-Loss Orders: Stop-loss orders can help protect your investments by automatically selling a security when it reaches a predetermined price. This strategy can prevent emotional reactions from leading to significant losses.

- Practice Mindfulness and Patience: Mindfulness techniques, such as meditation and deep breathing exercises, can help you stay calm and focused during market fluctuations. Cultivating patience and avoiding impulsive decisions can improve your investment discipline.

By managing your emotional reactions and adhering to a well-defined investment plan, you can navigate market volatility with greater confidence and make more rational investment choices.

4. Combat Overconfidence

Overconfidence is a common behavioral pitfall in investing, where individuals overestimate their knowledge, skills, and ability to predict market movements. This bias can lead to excessive trading, underestimation of risks, and poor investment performance. Behavioral finance research highlights the dangers of overconfidence and the importance of humility in investing.

How to Combat Overconfidence:

- Track Your Investment Performance: Keep a detailed record of your investment decisions and their outcomes. Regularly assess your performance to identify trends and areas for enhancement.

- Seek Feedback and Advice: Consult with financial advisors or experienced investors to gain insights and feedback on your investment strategy. Their perspectives can help you identify potential blind spots and avoid overconfidence.

- Stay Informed and Educated: Continuously update your knowledge of the stock market, investment strategies, and behavioral finance principles. The more you learn, the more you realize the complexity of investing, which can help temper overconfidence.

By acknowledging the limitations of your knowledge and seeking continuous improvement, you can reduce the impact of overconfidence and make more informed investment decisions.

5. Embrace Long-Term Thinking

Short-termism, or the tendency to focus on short-term gains at the expense of long-term objectives, is a common behavioral pitfall in investing. This behavior is often driven by the desire for quick profits or the pressure to meet immediate financial goals. However, successful investing requires a long-term perspective and the discipline to stay committed to your investment strategy.

How to Embrace Long-Term Thinking:

- Set Realistic Expectations: Understand that investing in the stock market is a long-term endeavor and that short-term fluctuations are inevitable. Set realistic expectations for your investment returns and remain patient.

- Focus on Fundamentals: Base your investment decisions on the underlying fundamentals of the companies you’re investing in, rather than short-term market trends. Evaluate factors such as earnings growth, competitive advantage, and management quality.

- Regularly Review and Adjust Your Portfolio: Periodically review your investment portfolio to ensure it aligns with your long-term goals and risk tolerance. Make adjustments as needed, but avoid making frequent changes based on short-term market movements.

By maintaining a long-term perspective and focusing on the fundamentals, you can avoid the pitfalls of emotional investing and achieve more consistent investment success.

Conclusion

Investing in the stock market can be a rewarding journey, but it requires careful navigation of various behavioral pitfalls and emotional states. By recognizing and addressing cognitive biases and embracing long-term thinking, you can make more rational investment decisions and improve your overall financial outcomes.

Behavioral finance provides valuable insights into these common pitfalls, helping investors develop strategies to overcome them and achieve their investment goals. This involves understanding how psychological factors such as fear, greed, and cognitive biases influence your decisions and learning to mitigate their impact.

Remember, successful investing is not just about picking the right stocks, but also about understanding and managing your behavior. It’s about developing a disciplined approach, staying informed, and continually refining your strategy to adapt to changing market conditions.