When entering the world of investing, understanding the types of stocks available can make a significant difference in how you build and manage your portfolio. A diversified portfolio is crucial for managing risk and achieving long-term growth.

Stocks represent shares of ownership in a company. When you purchase a stock, you are buying a piece of the company’s assets and earnings. There are many types of stocks, but they are generally categorized based on the company’s size, the market sector, dividend payments, and potential for growth, among several other factors.

In this article, will overview the various types of stocks, focusing on their unique characteristics and how they can fit into an investor’s investment strategy.

Major Types of Stocks in Stock Market

Common and Preferred Stocks

Common stocks are what most people think of when they consider investing in equities. Holders of common stocks usually have voting rights, which allow them to vote on corporate matters, such as choosing the board of directors. While common stocks may pay dividends, these payments can fluctuate according to the company’s profitability.

Preferred stocks are somewhat of a hybrid between stocks and bonds. These shares offer no voting rights but provide a fixed dividend, which makes them attractive to investors looking for steady income. Preferred stockholders are first in line in receiving dividends and recovering investments in case of bankruptcy or liquidation, making it a more stable but lower-return investment compared to common stock. In the event of a company liquidation, preferred shareholders are paid before common shareholders, though after bondholders.

Large-Cap Stocks

Large-cap stocks belong to companies with a market cap typically above $10 billion. These companies have a division based on their market capitalization, which differentiates between large-cap, mid-cap, and small-cap companies. Market capitalization determines the value of well-established companies and identify elite stocks with a long track record of increasing dividends. These companies are usually leaders in their industries and incorporate stable earnings, regular dividends, and less volatility. Investors value large caps for their proven track records and reliability.

Mid-Cap Stocks

Mid-cap stocks represent medium-sized companies, generally with market caps between $2 billion and $10 billion. These companies offer a balance between the fast growth of small-cap companies and the stability of large-cap companies. Investing in mid-caps can be a strategy to achieve higher growth potential while mitigating some of the risks associated with smaller companies.

Small-Cap Stocks

Small-cap stocks are typically from companies with market caps between $300 million and $2 billion. These stocks can be more volatile and risky, but they also offer significant growth potential. Small-caps are less likely to pay dividends and are often considered by investors willing to accept higher risk for the possibility of higher returns.

Blue Chip Stocks

Blue chip stocks are the most popular and well-known type of stock. They are the shares of large, well-established companies with a long history of financial stability and profitability. These companies are typically household names, and their stocks are often considered safe and reliable investments. Blue chip stocks provide consistent returns and protect a portfolio from steep losses, making them a key component of a defensive investment strategy.

Some examples of blue chip stocks include Amazon, Microsoft, and Meta. These companies have a proven track record of success, and investors often buy their stocks for their dividend income and capital appreciation potential.

Blue chip stocks are a great option for investors who are looking for a low-risk investment with steady returns.

Cyclical Stocks

Cyclical stocks are shares of companies whose performance is closely tied to the economic cycle.

These companies tend to do well when the economy is booming but may struggle during economic downturns. Industries like automotive, construction, restaurants, and luxury goods are examples of sectors where cyclical stocks are prevalent.

Some examples of cyclical stocks include Ford, Caterpillar, and Tiffany & Co. These companies’ performance tends to mirror the overall economic conditions, making them more volatile but potentially rewarding for investors who can time their investments well.

Non-cyclical/Defensive Stocks

Defensive stocks are shares of companies that tend to perform well regardless of the economic conditions. These stocks are often from publicly traded companies known for their stability and ability to generate income even during economic downturns.

These companies offer products that consumers continue to purchase even during economic downturns, making them a reliable choice for investors seeking stability in their portfolios. Industries like utilities, healthcare, and consumer staples are typical sectors where defensive stocks can be found.

Penny Stocks

Penny stocks are typically priced below $5 per share and are often associated with small companies. While they offer the potential for significant gains, they are also highly speculative and carry a high level of risk due to their low liquidity and large bid-ask spreads.

Investing in penny stocks requires a tolerance for risk and a willingness to potentially lose one’s entire investment.

Growth Stocks

Growth stocks are the shares of companies that are expected to grow at a faster rate than the average company in the market. The stock price of these growth stocks can significantly impact investor returns, as it often reflects the intrinsic value and future growth potential of the company. These companies are often in the early stages of their growth cycle and are not yet profitable. However, they have a unique product or service that has the potential to disrupt the market and generate significant revenue and profits in the future.

They are a great option for investors who are willing to take on more risk in exchange for the potential for higher returns.

Value Stocks

Value stocks are shares of companies that are undervalued by the market. These companies often have a strong financial position, but their stock prices are lower than their intrinsic value.

Value investors look for these undervalued stocks and buy them with the expectation that their prices will increase over time.

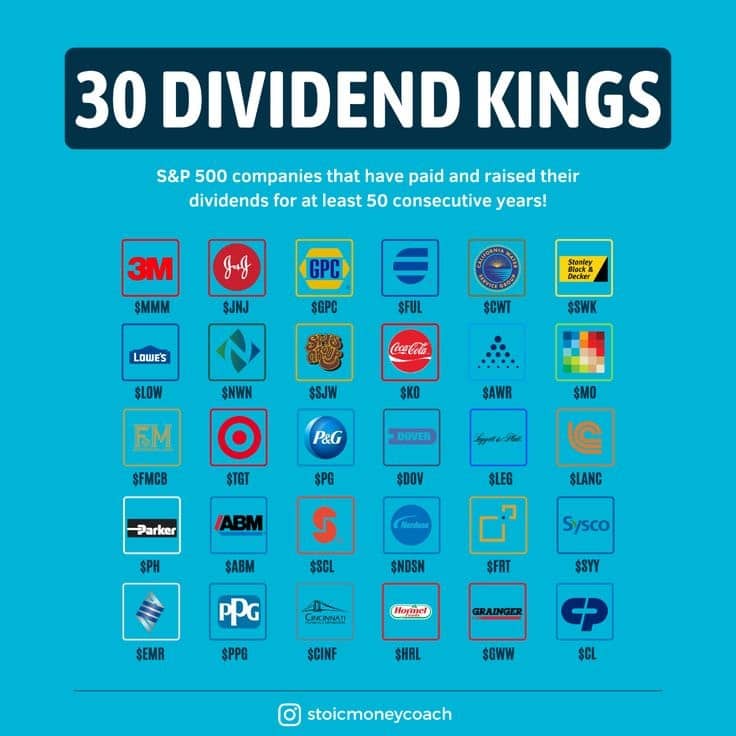

Dividend kings

These stocks, particularly dividend kings, offer numerous benefits such as regular income and potential long-term capital appreciation, but they also come with risks like market volatility and taxation considerations. Dividend kings are a prestigious group of stocks distinguished by their history of increasing dividends for at least 50 consecutive years. This elite status is not only a testament to the company’s stable earnings but also its robust business model.

Investing in dividend kings can be particularly appealing for those looking for reliable income from their investments along with the potential for long-term capital appreciation.

Sector-Specific Stocks

Sector-specific stocks have multiple types according to the shares’ relevant sectors. Some common sector stocks are:

- Financial Stocks

Including everything from banks and investment companies to insurance firms, financial stocks are integral to the economy. The performance of these stocks correlates to interest rates and the overall health of the economy.

- Energy Stocks

Energy stocks cover a range of companies involved in the production and distribution of energy, including oil, gas, and renewable energy firms. These stocks are particularly sensitive to changes in energy prices and regulatory policies.

- Technology Stocks

Often considered growth stocks, technology companies range from internet giants to emerging startups focusing on AI. While these stocks offer high growth potential, they also come with high volatility and competition risks.

- Healthcare Stocks

Healthcare stocks can be either growth stocks or blue chip stocks. This sector includes everything from biotech startups to well-established pharmaceutical firms. The growth potential in healthcare is driven by innovation, demographic trends, and increasing global access to medical services.

Sector-specific stocks can be part of a diversified investment portfolio, contributing to long-term growth and stability by investing in both domestic and international stocks, as well as incorporating Dividend Kings.

International Stocks

Expanding beyond domestic markets, international stocks open up opportunities in foreign economies. These stocks are good for diversifying investment portfolios and can be categorized by developed markets (like Europe and Japan) and emerging markets (like China and India). Exchange traded funds (ETFs) can be a convenient way to invest in international stocks and achieve diversification.

While international stocks offer high growth potential, they also carry risks associated with political instability, currency fluctuations, and differences in regulatory environments.

Special Situation Stocks

Special situation stocks are the shares of companies that are going through a significant event, such as a merger, acquisition, or restructuring. These stocks extend the potential for high returns, but they also come with higher risk, as the outcome of the event is uncertain.